Ever wondered what that tiny set of numbers on your American Express card means? Well, buckle up because we're diving deep into the world of American Express CVV codes. If you're anything like me, you've probably scratched your head trying to figure out what it does and why it’s so important. Let’s break it down for ya.

Shopping online has become second nature these days, and whether you're snagging the latest sneakers or booking that dream vacation, you’ll eventually run into the American Express CVV code. But here’s the thing—it’s not just some random set of numbers. It’s a crucial part of keeping your financial info safe while transacting online.

So, why should you care? Well, understanding your American Express CVV code can help protect you from fraud and ensure smoother transactions. Plus, it’s one of those tiny details that can save you a lot of headaches in the long run. Let’s get started!

- Joey Morgan The Rising Star You Need To Know

- Who Is Tulsi Gabbards Husband Everything You Need To Know About Her Personal Life

Here’s a quick rundown of everything you need to know about American Express CVV codes. Whether you're a seasoned cardholder or new to the world of credit cards, this guide’s got you covered.

Table of Contents

- What is an American Express CVV Code?

- Where to Find Your American Express CVV Code?

- Why is the American Express CVV Code Important?

- American Express CVV Code and Security

- Differences Between CVV Codes on Various Cards

- Protecting Yourself from CVV Fraud

- How Long is Your American Express CVV Code Valid?

- Activating Your American Express CVV Code

- Common Issues with American Express CVV Codes

- Wrapping It Up

What is an American Express CVV Code?

Alright, let's start with the basics. The American Express CVV code is like your card's secret handshake. It's a unique set of numbers printed on your card that helps verify your identity during transactions. For Amex cards, this code is typically referred to as the CID (Card Identification Number).

Now, here's the kicker: unlike other credit cards, American Express uses a **4-digit CVV code** instead of the usual 3 digits. This extra digit adds an extra layer of security, making it harder for fraudsters to impersonate you.

- Meet The Current Members Of Celtic Thunder A Journey Through Music And Passion

- Irad Ortiz Jr Salary The Untold Story Behind The Numbers

How Does the CVV Code Work?

When you shop online or over the phone, merchants often ask for your CVV code to confirm that you're the rightful owner of the card. Think of it as your card's password—it proves that you have the physical card in hand.

But hold up, there’s more! The CVV code isn’t stored anywhere in the card's magnetic strip or chip. This means even if someone gets hold of your card details through a data breach, they won’t automatically have access to your CVV code. Pretty smart, huh?

Where to Find Your American Express CVV Code?

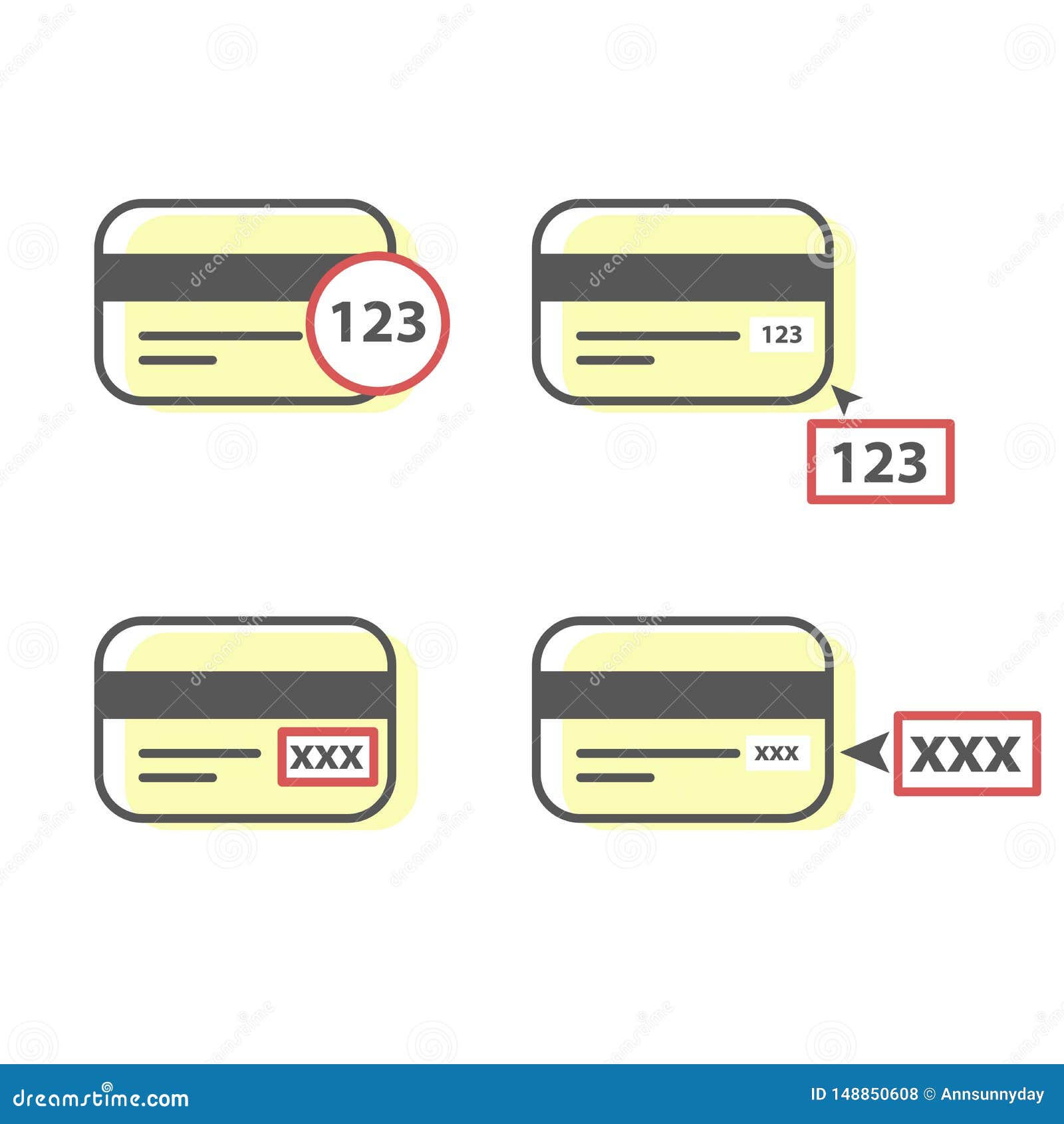

Locating your American Express CVV code is easier than you think. Unlike other cards where the CVV is usually on the back, Amex keeps it front and center. Here's how you can find it:

- Flip your card over and look at the front.

- On the far right side of your card number, you’ll see a 4-digit code. That’s your CVV.

- It’s usually printed above or near the card number, so it’s hard to miss.

Pro tip: Don’t confuse the CVV code with the last four digits of your card number. They’re not the same thing, so double-check before you enter it online.

Why is the American Express CVV Code Important?

Let’s get real for a sec. The American Express CVV code isn’t just some random number—it’s a key player in keeping your financial info secure. Here’s why:

1. Prevents Fraud: By requiring the CVV code during transactions, merchants can ensure that the person making the purchase is the actual cardholder. This reduces the risk of unauthorized transactions.

2. Protects Your Info: Since the CVV isn’t stored on the card's magnetic strip or chip, it adds an extra layer of security. Even if someone gets your card number, they still need the CVV to complete a transaction.

3. Smooth Transactions: Having the CVV code handy ensures that your transactions go off without a hitch. No more delays or errors because you forgot to enter it.

Real-Life Example

Imagine you’re shopping online and you enter your card details. Without the CVV code, the merchant can’t verify that you’re the real cardholder. This could lead to declined transactions or even fraud if someone else gets hold of your card info.

American Express CVV Code and Security

Security is a big deal when it comes to credit cards, and American Express knows it. That’s why they’ve gone the extra mile to make sure your CVV code stays safe. Here’s how:

1. Encryption: When you enter your CVV code online, it’s encrypted to protect it from hackers. This ensures that even if someone intercepts your data, they won’t be able to read it.

2. Merchant Restrictions: Merchants aren’t allowed to store your CVV code after a transaction. This means that even if their systems get breached, your CVV remains safe.

3. Card Verification: American Express uses advanced algorithms to verify your CVV code during transactions. This helps detect and prevent fraudulent activity in real-time.

What Happens if Someone Gets Your CVV Code?

If someone gets hold of your CVV code, they could potentially use it to make unauthorized transactions. That’s why it’s crucial to keep your CVV code private and never share it with anyone. If you suspect fraud, contact American Express immediately to freeze your account and issue a new card.

Differences Between CVV Codes on Various Cards

Not all CVV codes are created equal. While American Express uses a 4-digit code, other cards like Visa and Mastercard stick to the traditional 3 digits. Here’s a quick breakdown:

- American Express: 4-digit CVV code located on the front of the card.

- Visa and Mastercard: 3-digit CVV code located on the back of the card, usually near the signature strip.

- Discover: 3-digit CVV code on the back, similar to Visa and Mastercard.

Why the difference? Well, it’s all about security. By using a different format, American Express makes it harder for fraudsters to guess or duplicate their CVV codes.

Protecting Yourself from CVV Fraud

CVV fraud is real, and it’s something every cardholder should be aware of. Here are some tips to keep your American Express CVV code safe:

- Never Share Your CVV Code: Treat your CVV code like a password—don’t share it with anyone, not even family or friends.

- Use Secure Websites: Always check that the website you’re shopping on is secure. Look for the padlock icon in the URL bar and ensure the site starts with "https://".

- Monitor Your Account: Keep an eye on your transactions and report any suspicious activity to American Express immediately.

- Enable Alerts: Most banks and credit card issuers offer transaction alerts via text or email. This way, you’ll know instantly if someone tries to use your card without your permission.

What to Do if You’re a Victim of CVV Fraud

If you suspect CVV fraud, don’t panic. Here’s what you should do:

- Contact American Express immediately to report the fraud.

- Freeze your account to prevent further unauthorized transactions.

- Request a new card with a new CVV code.

- File a dispute for any fraudulent charges.

How Long is Your American Express CVV Code Valid?

Your American Express CVV code is valid for the life of your card. This means that as long as you have the same physical card, your CVV code won’t change. However, if you request a new card or your card expires, you’ll get a new CVV code.

Pro tip: If you’re traveling or planning to make a big purchase, make sure your card and CVV code are up to date. Nothing’s worse than having your transaction declined because your card info is outdated.

Activating Your American Express CVV Code

Here’s a common question: Do you need to activate your American Express CVV code? The short answer is no. Your CVV code is automatically activated when your card is issued. However, if you’ve requested a replacement card, you may need to activate it before using it.

To activate your card, simply call the number on the back or use the American Express app. It’s quick, easy, and ensures that your CVV code is ready to go.

Common Issues with American Express CVV Codes

Even the best systems can have hiccups. Here are some common issues you might encounter with your American Express CVV code and how to fix them:

- Incorrect CVV Code: Double-check that you’ve entered the right numbers. If the issue persists, contact American Express for assistance.

- Expired Card: If your card has expired, you’ll need to request a new one with a new CVV code.

- Blocked Account: If your account is blocked due to suspicious activity, you’ll need to contact American Express to resolve the issue.

Remember, if you’re ever unsure about your CVV code or encounter issues, don’t hesitate to reach out to American Express customer support. They’re there to help!

Wrapping It Up

There you have it—everything you need to know about American Express CVV codes. From understanding what it is to keeping it safe, we’ve covered all the bases. Remember, your CVV code is a crucial part of your card’s security, so treat it with care.

So, what’s next? If you’re an American Express cardholder, make sure you’re familiar with your CVV code and how to use it safely. And if you’re not yet an Amex user, consider checking out their range of cards and benefits—they’re pretty legit!

Before you go, drop a comment below and let me know if you found this guide helpful. And hey, if you’ve got any questions or tips of your own, feel free to share them too. Until next time, stay safe and keep those CVV codes locked down!

- How To Delete Uber History A Comprehensive Guide

- Unveiling The Intricate Food Web In Chaparral Biome A Closer Look